7 Easy (But Brilliant) Ways To Boost Your Credit Score

Your credit score directly impacts your ability to buy a house in central Missouri. Your credit rating sums up your financial habits (such as the amount of different debts you have and your ability to pay them off in a timely fashion) into a single number that is designed to tell lenders how trustworthy you are.

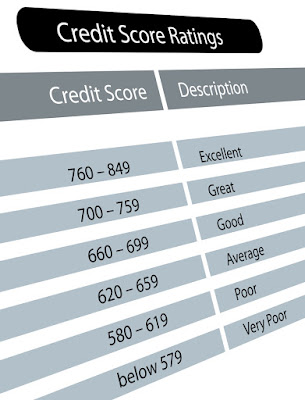

Any number below 579 is considered "very poor," and any number above 760 is considered "excellent." Lenders use these guidelines when deciding how much money to lend to borrowers and how high of an interest rate to charge them. If you have a high credit score, you will be viewed as less of a risk and you will probably qualify for higher loan amounts at lower interest rates.

When it comes to a purchase as big as a home, having a high credit score is essential if you want to keep costs down. The team at Devine & Associates Real Estate is here to help with these simple suggestions to help you raise your credit score.

#1 - Keep The Balances On Your Credit Cards Low.

Did you know that the amount of outstanding debt you have directly impacts your credit score? In order to have the best affect on your credit rating, you should keep the balances on your credit cards at or below 30% of your total credit limit.

#2 - Be Choosy About Your New Lines Of Credit.

Just like the amount of outstanding debt you you have, the number of different lines of credit you have will also impact your score. Having multiple credit cards, student loans, a car payment, and a house payment can cause you to be viewed as a risk to potential lenders. You can keep your credit score up by only opening new lines of credit when you really need to.

#3 - By Your Bills In Full And On Time... Every Time.

Since your credit score is supposed to tell lenders how much they can trust you to pay back your loan on time, the worst thing you can do is make late or partial payments on the debts you owe. Paying all your bills in full and on time is the best way to keep your credit rating high.

#4 - Reduce Your Debts Wherever Possible.

If you have the funds to pay off a remaining balance on your student loan, car loan, or credit card debt, do it. Not only will this help to boost your credit score - it will also reduce the total amount of money you will spend on interest!

#5 - Don't Cancel Old Credit Cards.

Even if you never use them, keeping old credit cards may be a clever way to increase your credit score. One of the factors that impacts your score is the length of time you have had your different lines of credit. By keeping your old cards active (but showing that you can handle them responsibly), you can be seen as more trustworthy and reliable.

#6 - Ask Someone To Make You An Authorized User.

Being an authorized user means you have a credit card in your name that is linked to someone else's account. If you are an authorized user on someone else's credit card, your score will be impacted by their payment history on that card. If you have a spouse or trusted friend/family member who makes responsible payments on their credit cards, you can ask them to make you an authorized user on their card to help boost your score.

#7 - Shop For Loans In A Timely Manner.

Every time a potential creditor pulls your credit information, your score takes a hit. However, creditors understand that buyers may want to get quotes from multiple lenders to find the most affordable option. If multiple creditors pull your information in a short period of time, your credit score will not be impacted as negatively.

Contact Devine & Associates When You're Ready To Buy!

It's never too soon to start working on increasing your credit score. It's also never too soon to start looking at some of the homes for sale near the Lake of the Ozarks! Even if you aren't planning on purchasing immediately, you can contact our team to schedule showings of some of the homes currently on the market. Viewing potential homes ahead of time can give you some ideas for what to look for when you are really ready to buy. Give us a call to get started!

Any number below 579 is considered "very poor," and any number above 760 is considered "excellent." Lenders use these guidelines when deciding how much money to lend to borrowers and how high of an interest rate to charge them. If you have a high credit score, you will be viewed as less of a risk and you will probably qualify for higher loan amounts at lower interest rates.

When it comes to a purchase as big as a home, having a high credit score is essential if you want to keep costs down. The team at Devine & Associates Real Estate is here to help with these simple suggestions to help you raise your credit score.

#1 - Keep The Balances On Your Credit Cards Low.

Did you know that the amount of outstanding debt you have directly impacts your credit score? In order to have the best affect on your credit rating, you should keep the balances on your credit cards at or below 30% of your total credit limit.

#2 - Be Choosy About Your New Lines Of Credit.

Just like the amount of outstanding debt you you have, the number of different lines of credit you have will also impact your score. Having multiple credit cards, student loans, a car payment, and a house payment can cause you to be viewed as a risk to potential lenders. You can keep your credit score up by only opening new lines of credit when you really need to.

#3 - By Your Bills In Full And On Time... Every Time.

Since your credit score is supposed to tell lenders how much they can trust you to pay back your loan on time, the worst thing you can do is make late or partial payments on the debts you owe. Paying all your bills in full and on time is the best way to keep your credit rating high.

#4 - Reduce Your Debts Wherever Possible.

If you have the funds to pay off a remaining balance on your student loan, car loan, or credit card debt, do it. Not only will this help to boost your credit score - it will also reduce the total amount of money you will spend on interest!

#5 - Don't Cancel Old Credit Cards.

Even if you never use them, keeping old credit cards may be a clever way to increase your credit score. One of the factors that impacts your score is the length of time you have had your different lines of credit. By keeping your old cards active (but showing that you can handle them responsibly), you can be seen as more trustworthy and reliable.

#6 - Ask Someone To Make You An Authorized User.

Being an authorized user means you have a credit card in your name that is linked to someone else's account. If you are an authorized user on someone else's credit card, your score will be impacted by their payment history on that card. If you have a spouse or trusted friend/family member who makes responsible payments on their credit cards, you can ask them to make you an authorized user on their card to help boost your score.

#7 - Shop For Loans In A Timely Manner.

Every time a potential creditor pulls your credit information, your score takes a hit. However, creditors understand that buyers may want to get quotes from multiple lenders to find the most affordable option. If multiple creditors pull your information in a short period of time, your credit score will not be impacted as negatively.

Contact Devine & Associates When You're Ready To Buy!

It's never too soon to start working on increasing your credit score. It's also never too soon to start looking at some of the homes for sale near the Lake of the Ozarks! Even if you aren't planning on purchasing immediately, you can contact our team to schedule showings of some of the homes currently on the market. Viewing potential homes ahead of time can give you some ideas for what to look for when you are really ready to buy. Give us a call to get started!

Devine & Associates Real Estate

(573) 392-9900

Follow Us On...

Google+

Comments

Post a Comment